Written by Fernando Maciá

Index

The coronavirus crisis has impacted our society in multiple ways and on an unprecedented scale. The fight against an explosive expansion of COVID-19 has forced governments around the world to adopt drastic measures to control mobility, with a direct effect on the economic activity of companies – almost all of which has been paralyzed for several weeks – and the consumption habits of the population.

On March 11, 2020, the World Health Organization upgraded the public health emergency caused by COVID-19 to an international pandemic, and three days later, the Spanish Government declared a state of alert. This was the beginning of the mandatory confinement of the majority of the population and the reduction of all economic activity, except for that considered essential to maintain basic services and supplies.

Since then, several studies have been published on the impact of this crisis on the digital economy, such as the one called Covid-19: Impact on Digital Business Sectors. It is because of this study that I participated last week in a round table discussion on the topic “The impact of COVID-19“in the digital sector, together with Gemma Muñoz (The Art of Measuring) and Ricardo Tayar (Flat 101) organized by KSchool.

Although the Flat 101 study is enormously rich in data on the impact on traffic and conversion data of a broad panel of Spanish e-commerce businesses, I wanted to enrich the table with data more specific to the scope of work of Human Level, i.e. related to the impact of Covid-19 on search habits and SEO in general.

For this purpose, and without pretending to give these graphs a scientific validity, I consulted the evolution data of the search potentials of some of the most popular queries grouped by sector in tools such as Google Keyword Planner, Google Trends, Keywordtool.io, etc. And although in our Twitter thread we have already published some of these captures, we have compiled below the findings that we found most striking.

Buy online

The first reference to the impact of the crisis on user search behavior is related to the purchase of basic necessities, those that make up the weekly shopping of any household. In the first days of the confinement, the logistics and online sales processes of many supermarkets that already had this option were also affected by the shortage of certain products (toilet paper, hydroalcoholic gel, masks, disinfectant and cleaning products, etc.), so that the graph of Google Trends shows that first abrupt reaction of many users who felt an urgent need to stock up and accumulate supplies in these first days.

This trend became less pronounced as we realized that supply chains were still functioning and therefore there was no need for compulsive buying to stockpile products for the long term:

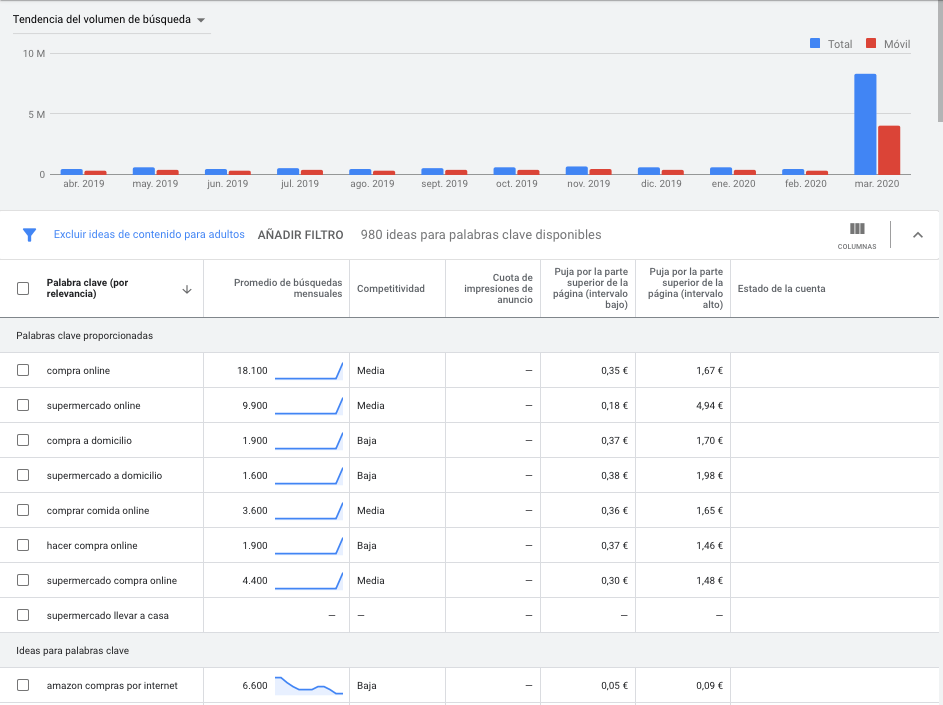

Despite the relaxation registered since mid-April, searches related to concepts such as “online shopping”, “online supermarket”, “home shopping”, etc. registered very significant growth in March, as we can see in Google Keyword Planner:

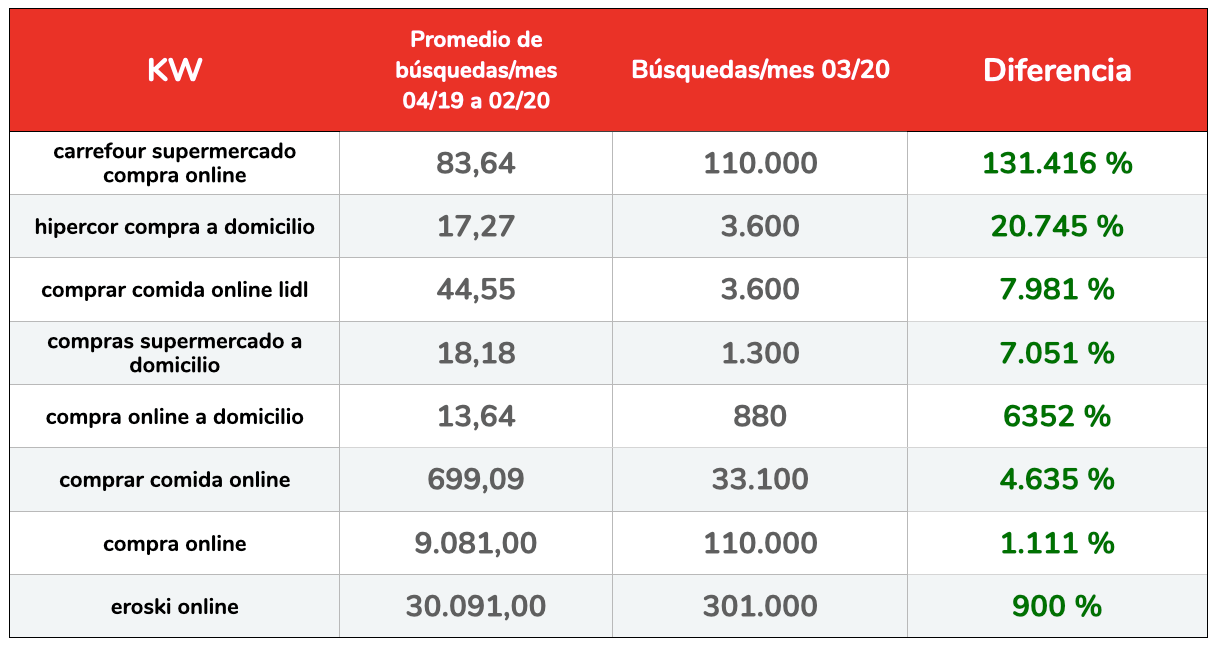

In the following table, we show the percentage increase of some monthly searches registered in Google Keyword Planner, comparing March 2020 searches with the average of the previous 11 months:

The growth of searches related to the online shopping or home delivery service of some of the most popular supermarkets, such as Carrefour, Eroski or Hipercor, is striking. The search “carrefour supermarket online shopping” went from an average of 85 searches per month to 110,000 in March 2020.

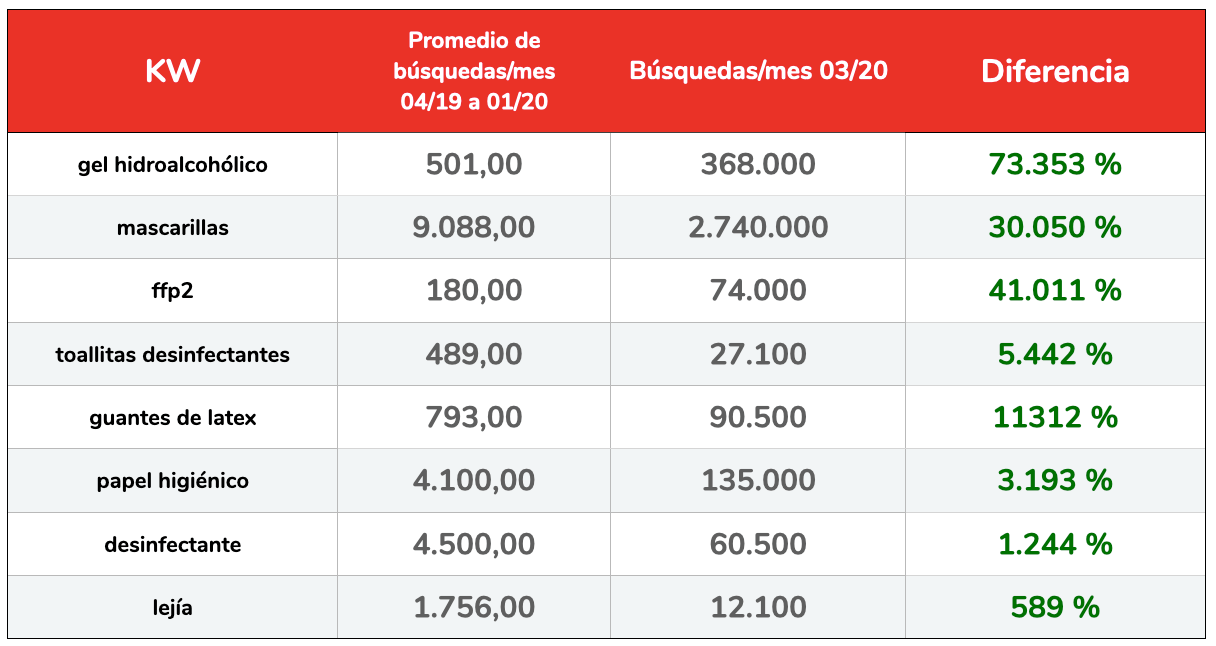

As for the products whose search generated the highest growth, those related to hygiene, cleaning, personal protection and disinfection were the real protagonists during the month of March 2020:

Demand for disinfectant gel, masks, gloves or toilet paper increased exponentially already during February, but more sharply in March 202o. This demand potential was, in many cases, was wasted due to shortages, the centralization of the units available for use in hospitals in the case of face masks, and the general stock-outs of the rest of the related products.

If you’d like to go deeper into improving visibility and sales from search, check our e-commerce SEO.

Travel sector

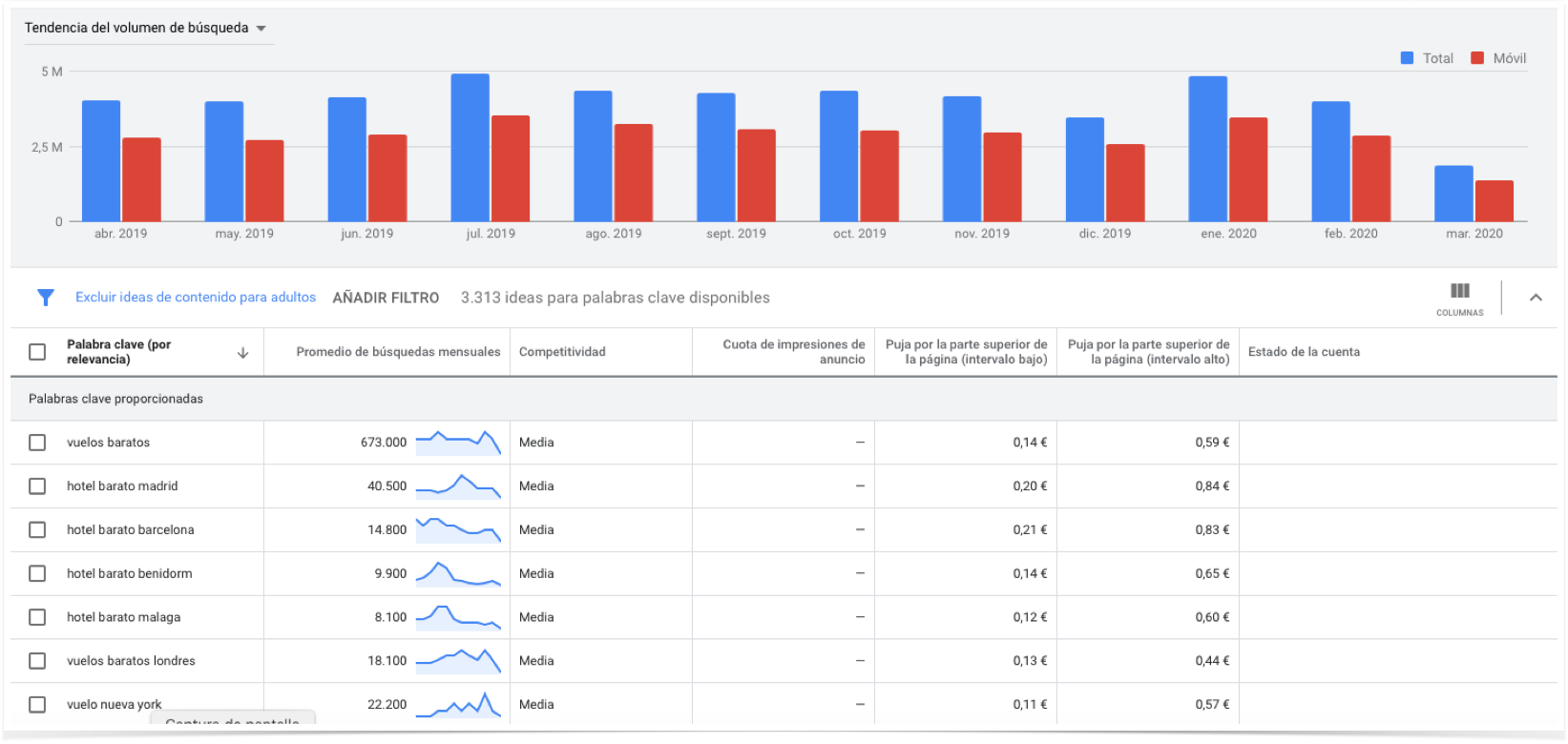

Severe restrictions on mobility have hit the travel and tourism sector particularly hard. Searches related to flights and hotels have decreased significantly during the month of March 2020:

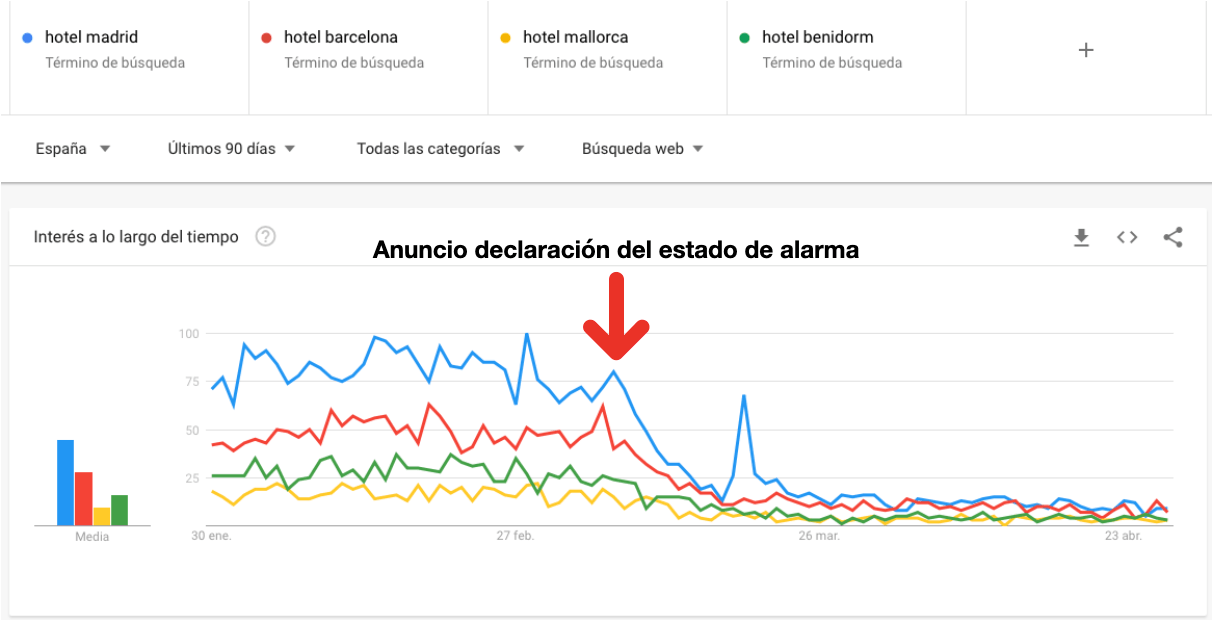

Google Trends clearly shows the impact of the declaration of the state of alarm on the search for hotels in some of the most popular destinations in Spain:

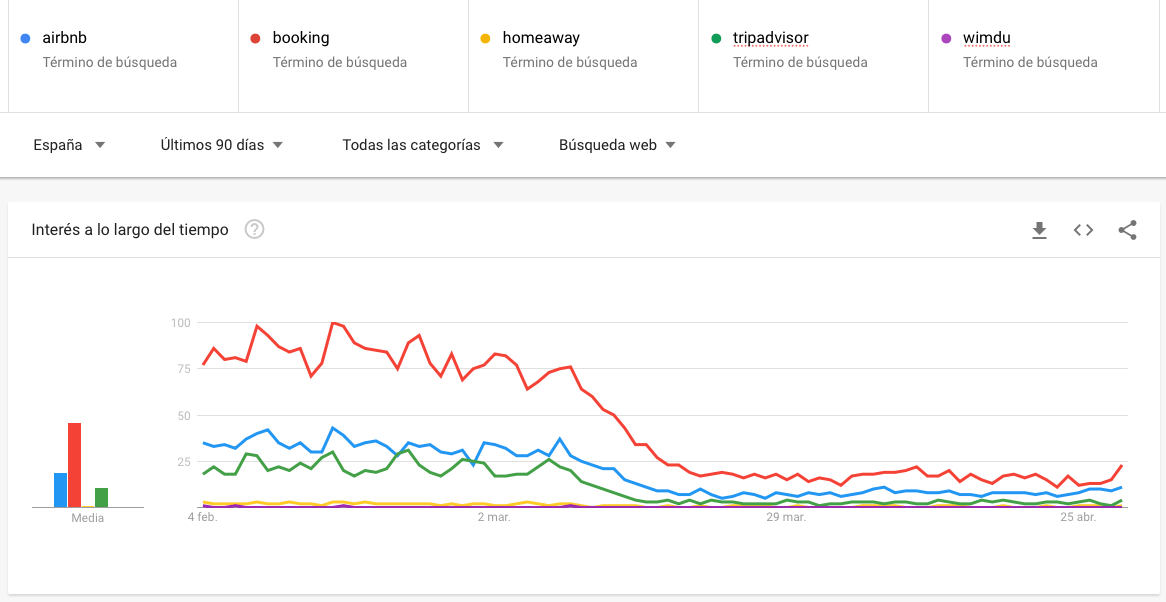

The major tourist apartment accommodation booking platforms such as Airbnb, Booking, Homeaway (now Vrbo), TripAdvisor or Wimdu were also affected:

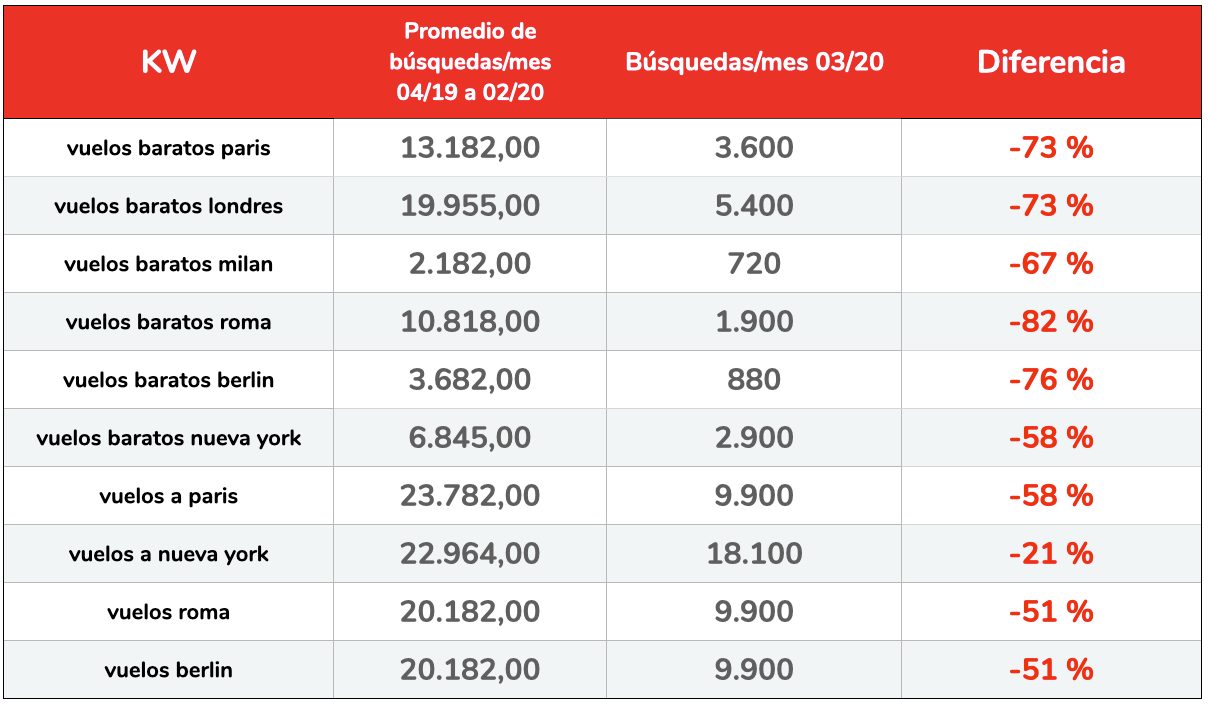

With respect to flight-related searches, there were significant drops for the most popular searches for the most sought-after destinations:

It is relevant to note that the drop percentages are more pronounced on searches for “cheap flights + destination” than when only “flights + destination” is included. Probably, the “cheap” qualifier is more related to a vacation search intention that in these circumstances would be postponed, while the “flight + destination” search could imply a real need to reach a certain destination (for example, because of the repatriations of tourists carried out after the declaration of the state of alarm).

To rebuild demand for destinations and travel brands aligning seasonality, content, and acquisition, see our SEO for the travel industry.

Entertainment and leisure

The possibilities for leisure and recreational activities, following the declaration of the state of alarm, have been relegated to the strictly domestic or family sphere. Searches related to physical exercise have experienced a very remarkable growth, both those related to the purchase of products and accessories as well as those related to the purchase of exercise charts and routines for home training.

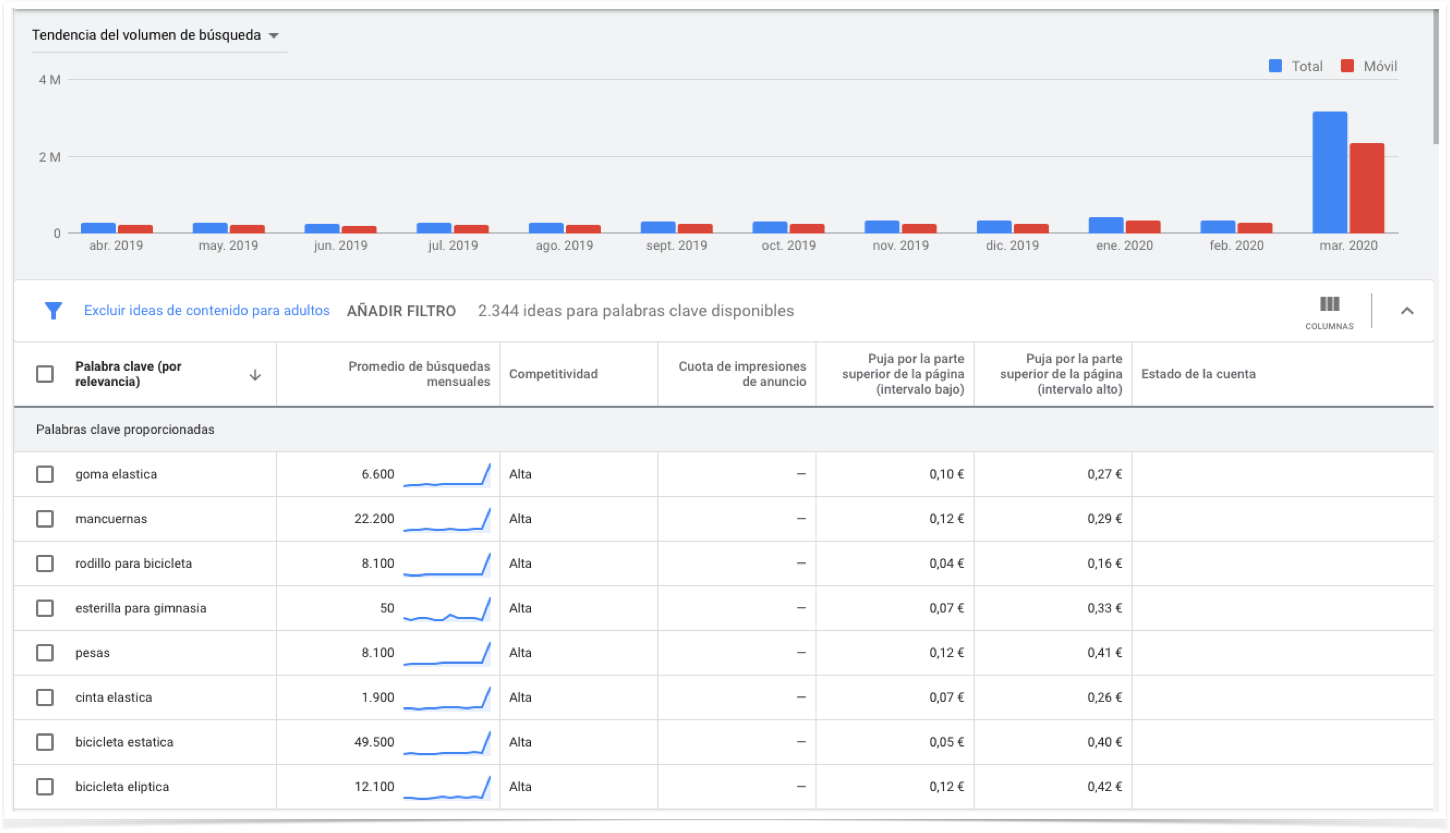

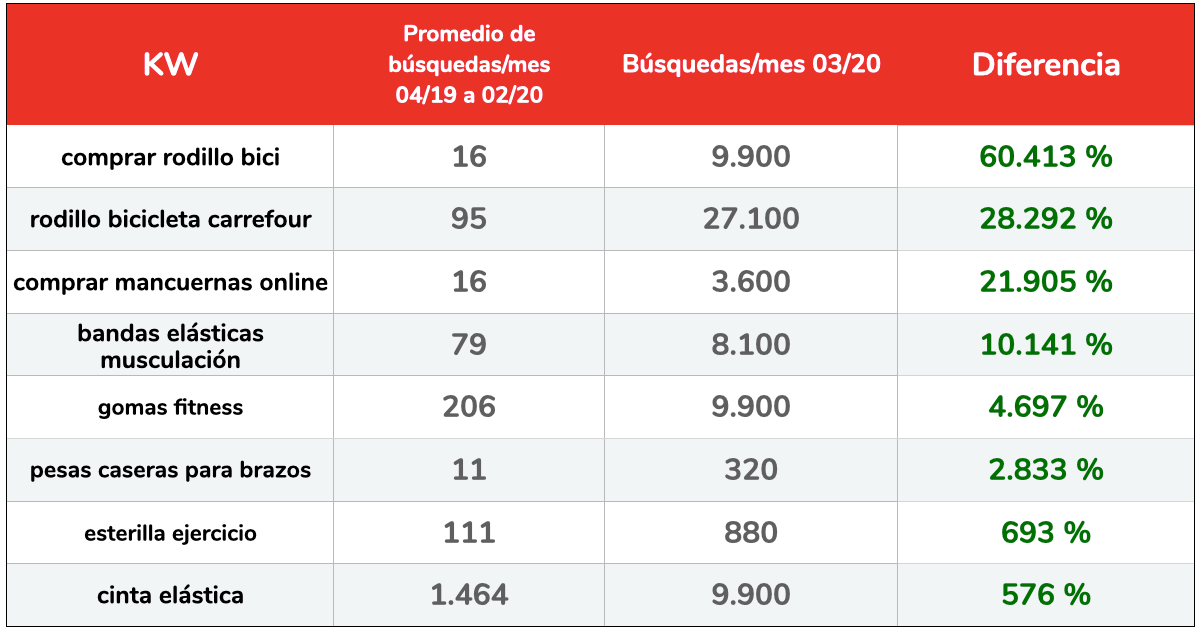

In terms of products for exercising at home, bicycle rollers have been the real protagonists, along with weights, dumbbells or fitness mats:

The percentage increases are spectacular for searches such as “buy bike trainer” or “carrefour bike trainer”, although “fitness bands” or “elastic band” are also growing significantly. It is clear that the most sporty have decided to exercise at home and did not waste time to equip themselves with everything they needed:

Although the Flat 101 study focused primarily on e-commerce and product sales, it is also noteworthy that confinement has created an impetus for us to make the best use of this time at home, not only by exercising but also by acquiring or perfecting new hobbies.

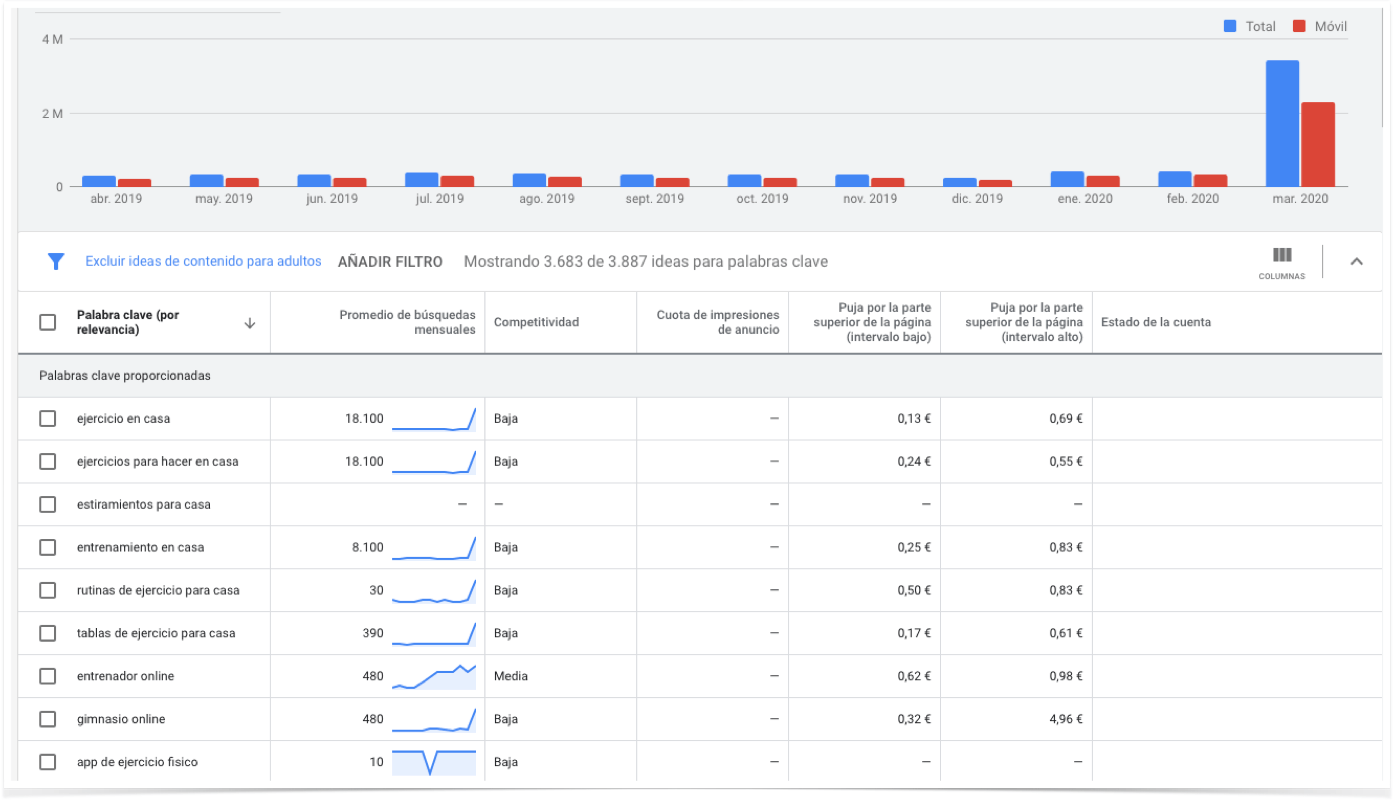

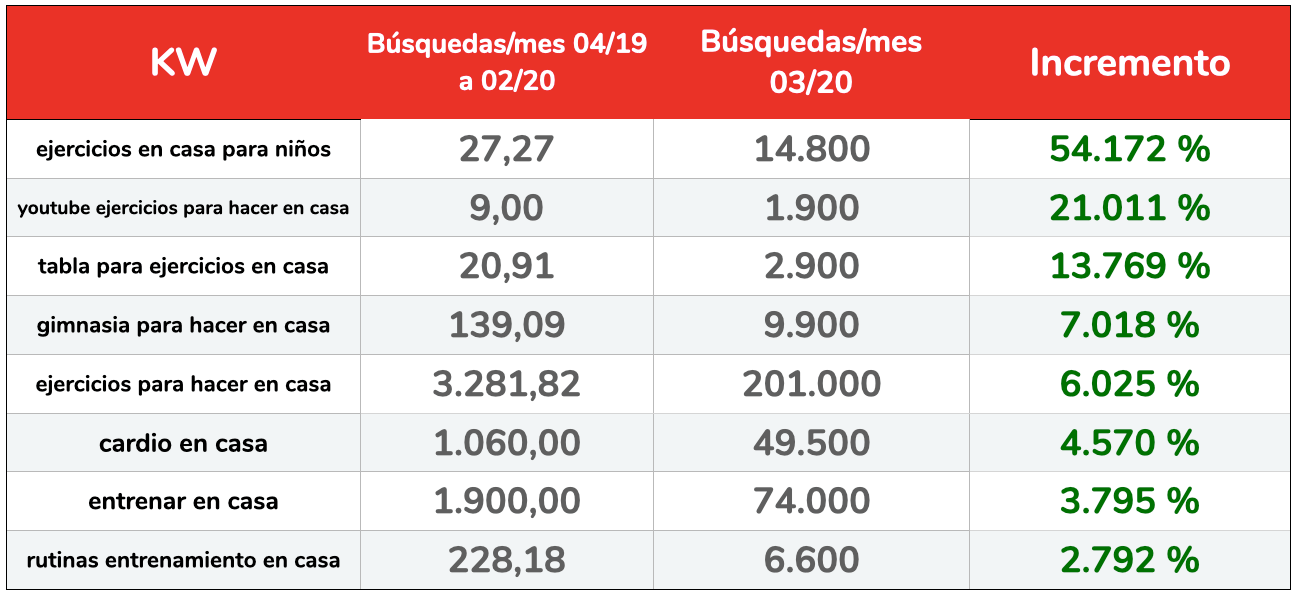

Thus, along with the purchase of products for doing sports at home, searches related to videos, apps or websites with training tips and routines, gymnastic charts, fitness exercises, etc., increased:

The presence of children at home turns searches such as “home exercises for children” into protagonists, which previously registered only 27 monthly searches and increased in March 2020 to 14,800. YouTube videos with exercise charts and websites with home workout routines were also searched:

Other facets that have experienced tremendous growth are those related to hobbies, such as cooking, or the consumption of online entertainment platforms (TV platforms or games), with a special impact on the launch of Disney+ coinciding with the confinement of millions of children and parents eager to find entertainment for them so they can work from home:

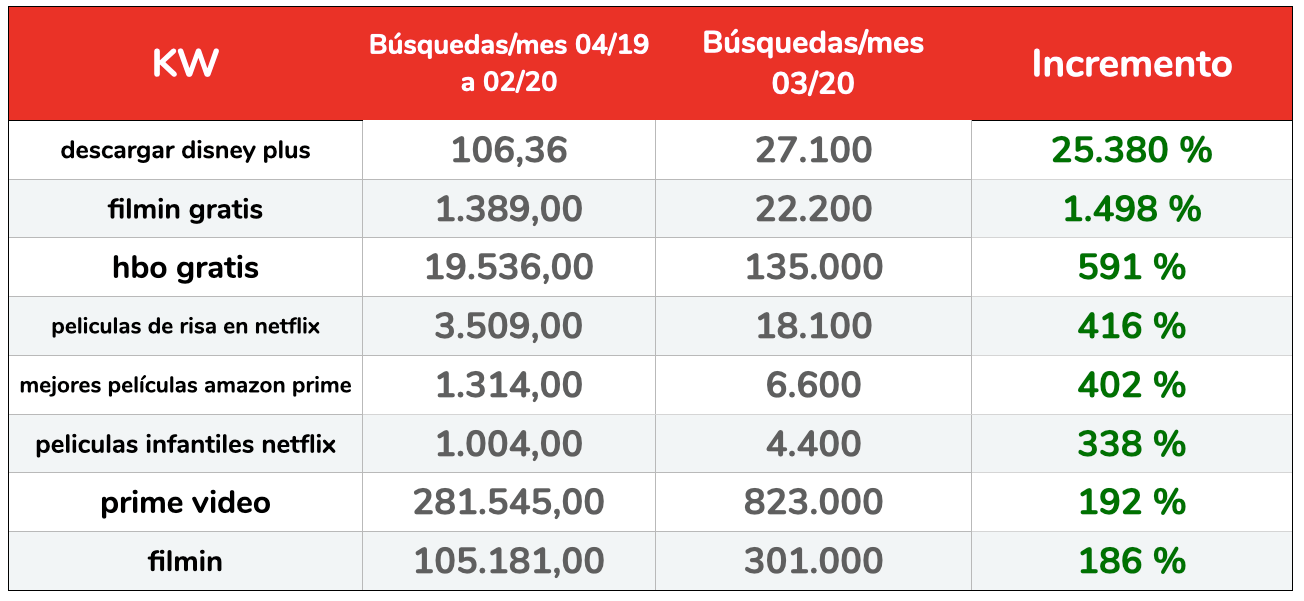

Some of the most striking growth is related to the download and installation of Disney+ and the search for open access to content from other platforms that launched special offers due to the COVID-19 crisis:

As we saw in the analysis of supermarket products that had grown the most, many were related to the ability to cook and bake at home. It is not surprising, therefore, that the search for cooking-related content also experienced a huge growth during these days:

Online training

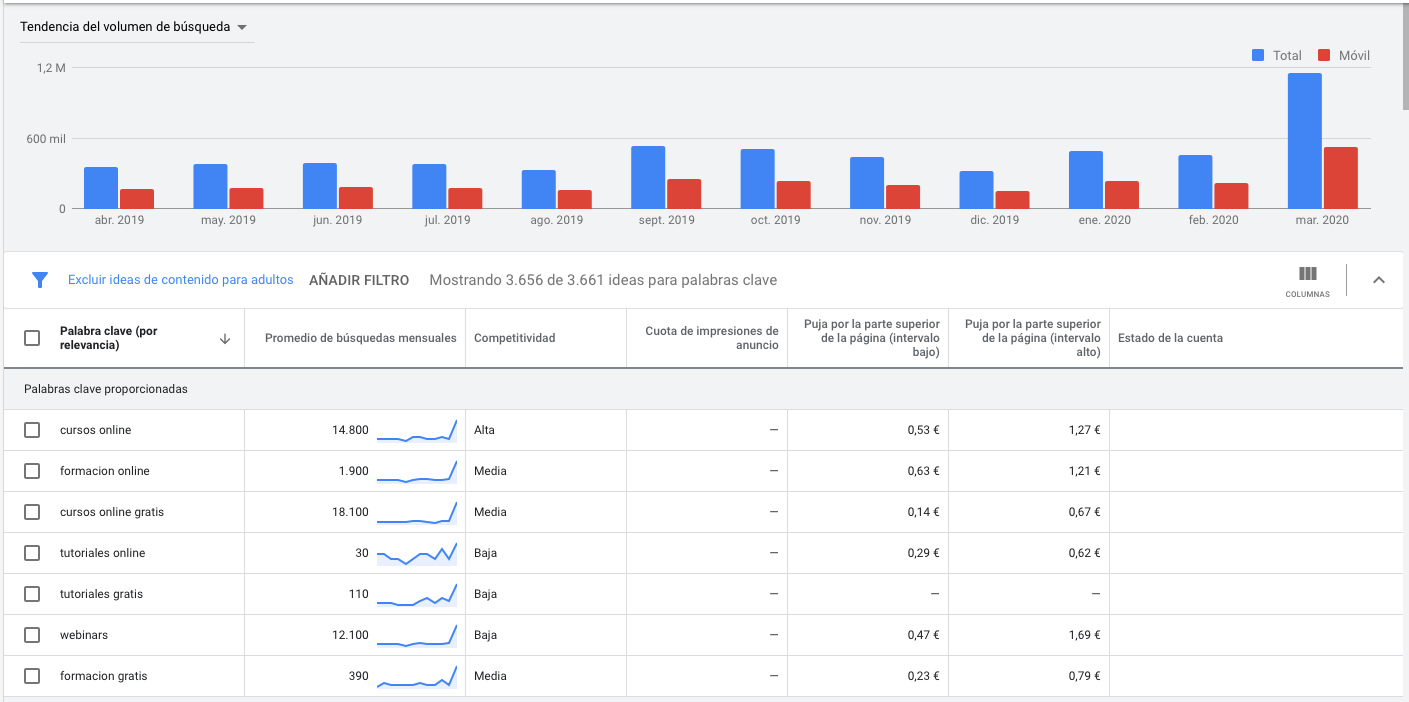

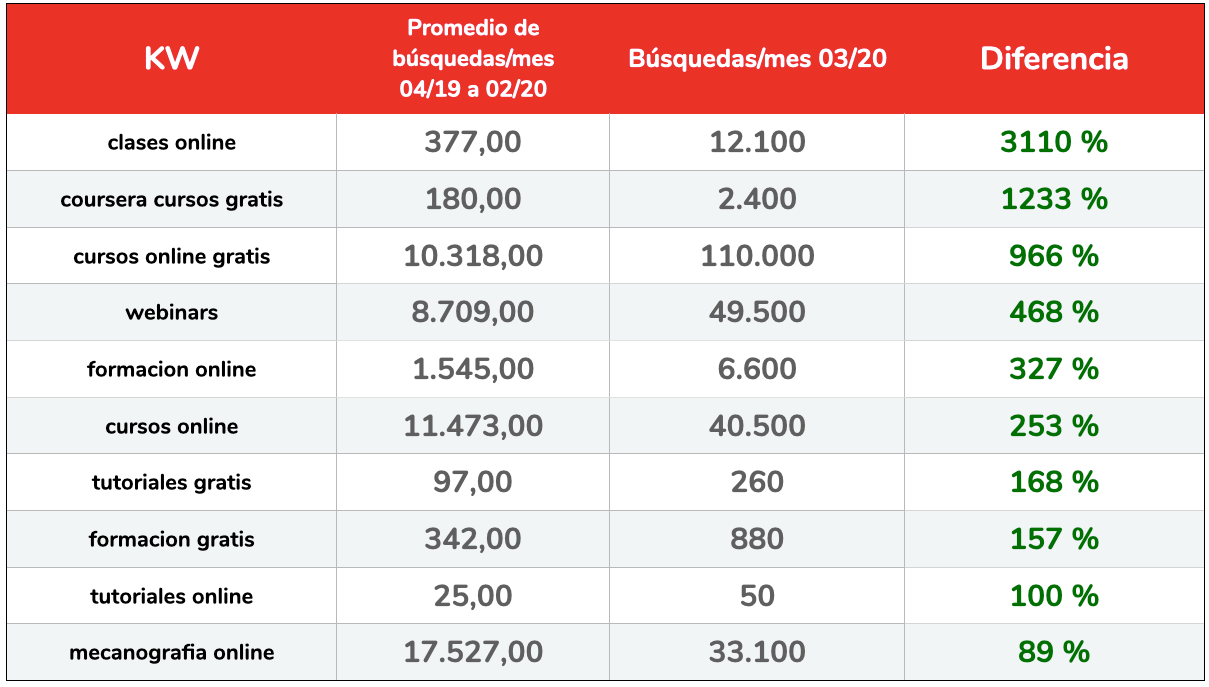

One of the big winners of this coronavirus crisis is the online training sector. With so much time to spend at home, Spaniards are looking for online training opportunities through multiple formats, such as courses, training, webinars, etc..:

The most significant growth was found in the search for “free online courses”, followed by webinars and online training. We also find the increase in searches related to “typing” particularly striking:

To capture this growing demand with SEO and content aligned to your enrollment cycles, check out our digital marketing for education.

Telework applications

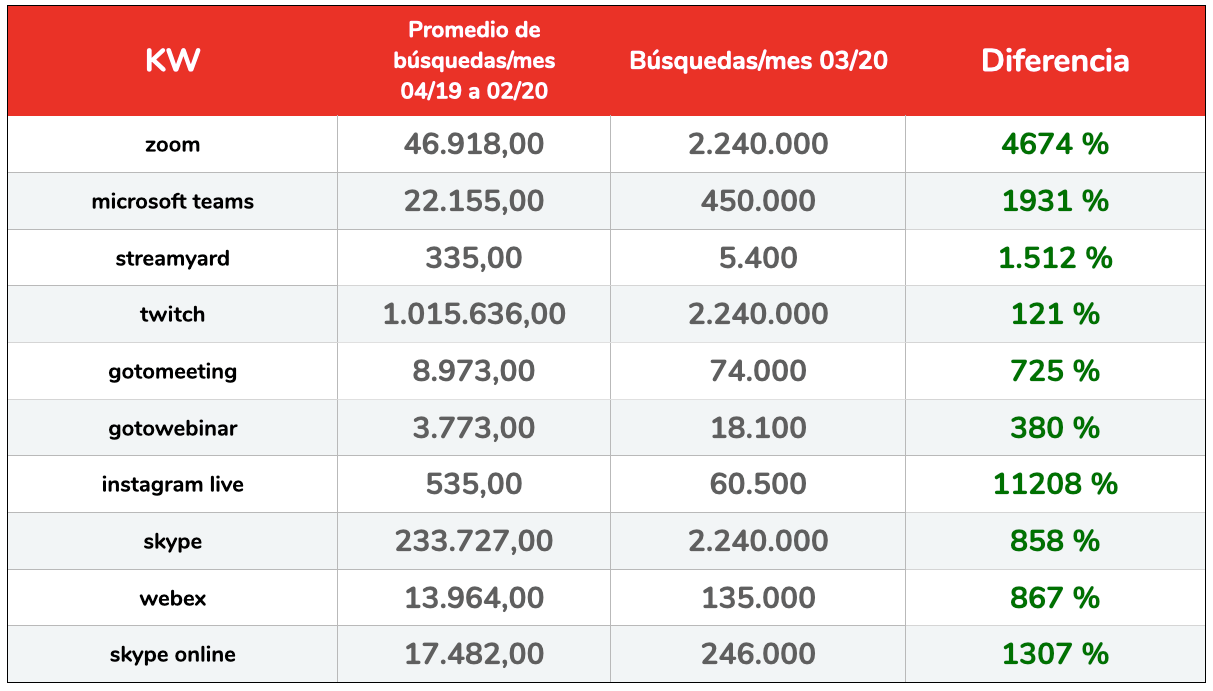

The homebound nature of employees in all non-core sectors has forced companies to adopt telework solutions at an accelerated pace. This is another sector for which the COVID-19 crisis has been a real catalyst:

The Google Trends graph also reflects (second red arrow) the reputational crisis suffered by the zoom platform that slowed its growth in favor of others such as Google Meet or Microsoft Teams. Other live video platforms such as Instagram Live or Streamyard also experienced notable growth in average monthly searches:

Automotive sector

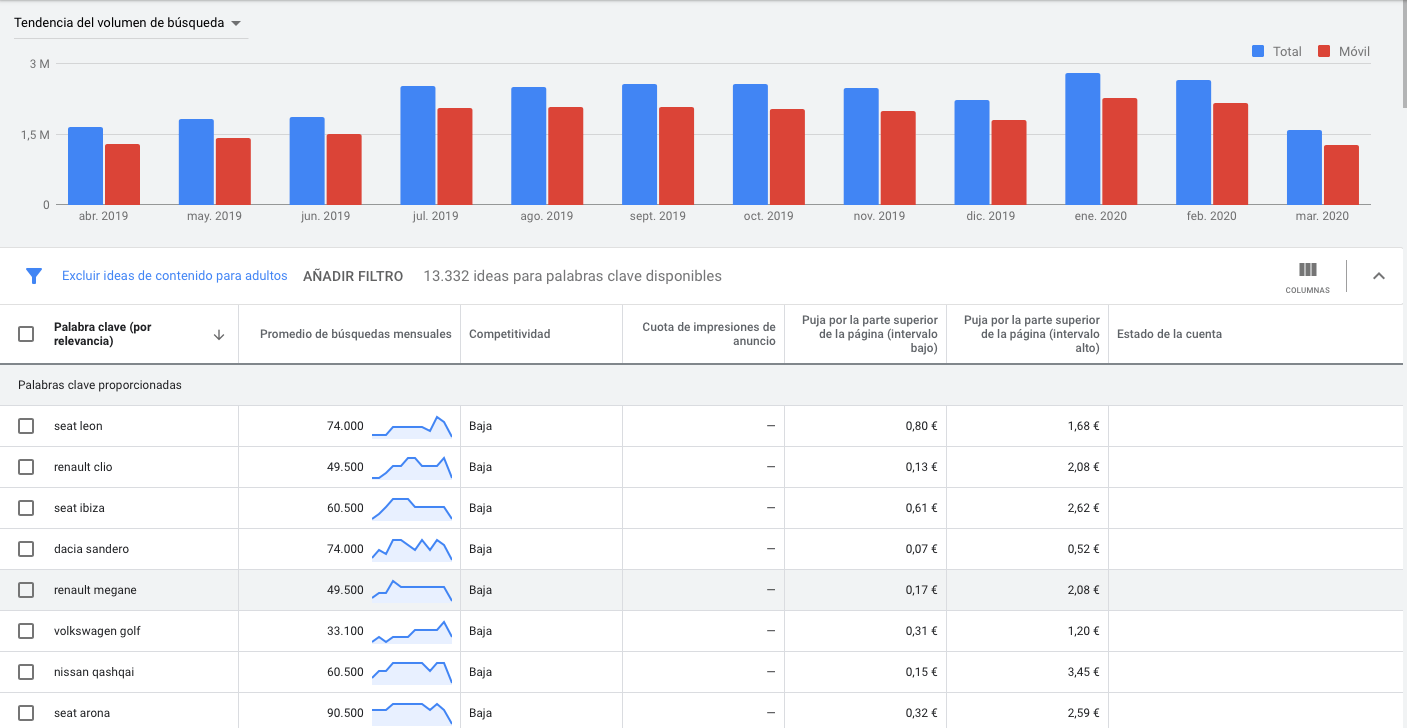

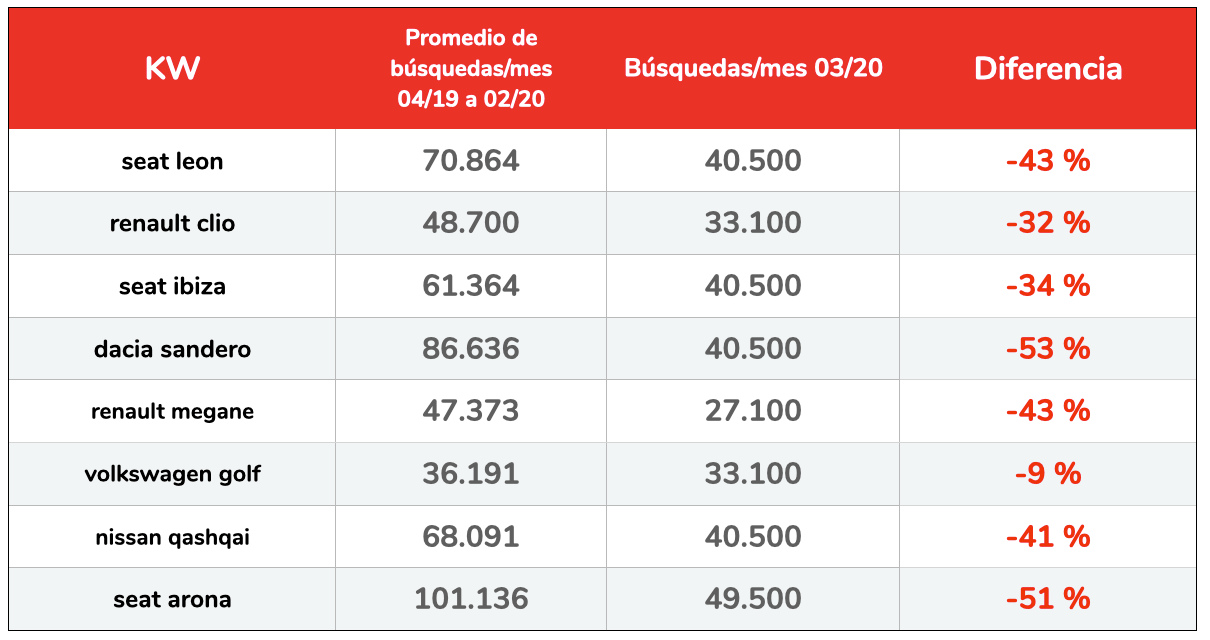

Vehicle sales have been one of the sectors most affected by the declaration of the state of alarm. However, the recovery of the role of the private vehicle in commuting to work due to the fear of sharing space on public transport could have an impact in the form of an upturn once the confinement ends. Searches related to the top ten best-selling models in 2019 recorded clear reversals in March 2020:

The drop in search potential is around 50%. It is striking that “volkswagen golf” stands out as the search that suffers the least from this decline:

Online banking

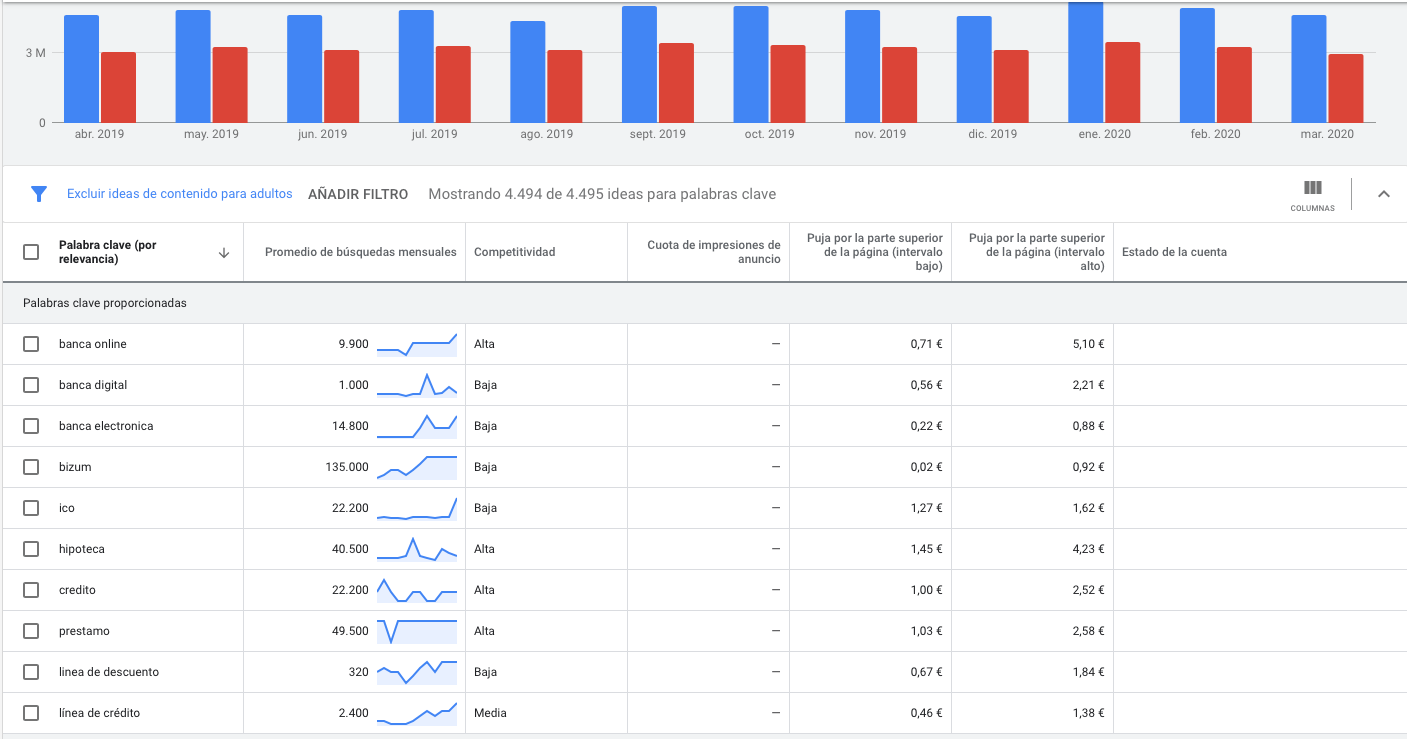

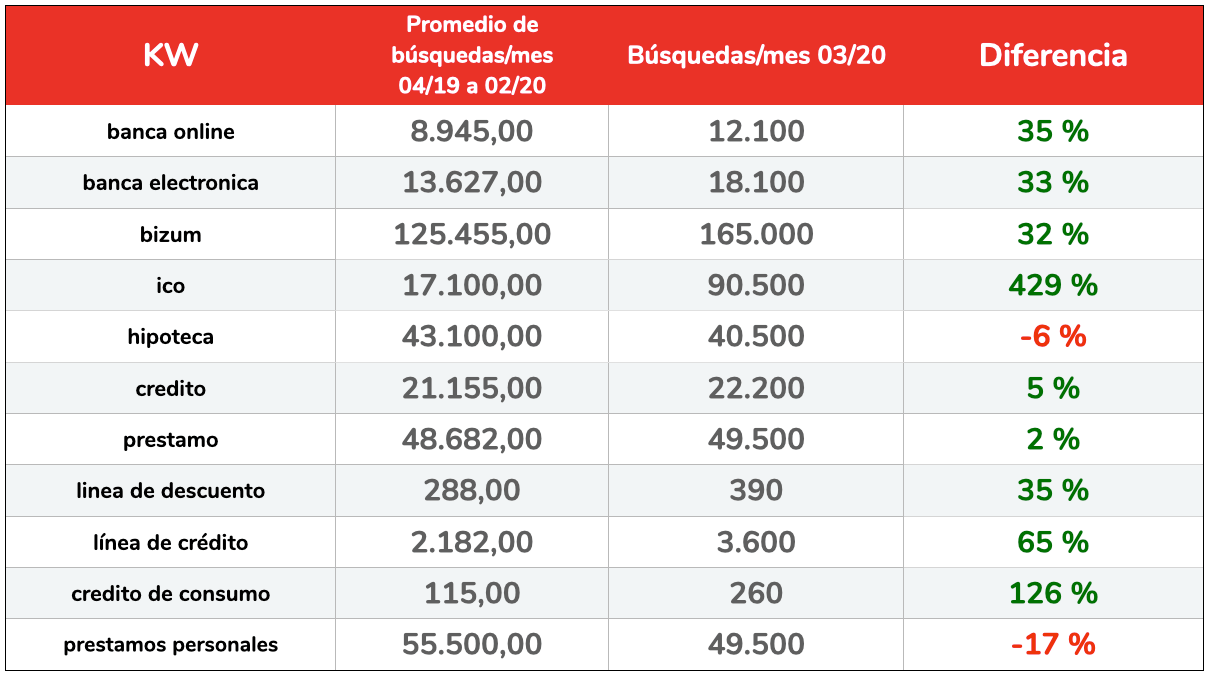

Banking procedures during the period of confinement have had to be channeled through the electronic banking platforms of the various financial institutions. However, the declaration of the state of alert has also affected operations such as taking out mortgages or applying for credit and loans:

The most significant growth is for the search related to ICO loans from the different lines of guarantees approved by the Government. Searches related to online banking, electronic banking and consumer credit are also on the rise. Personal loans and mortgages are down:

To prioritise digital channels and capture demand in online banking with full compliance, see our SEO for banking & insurance.

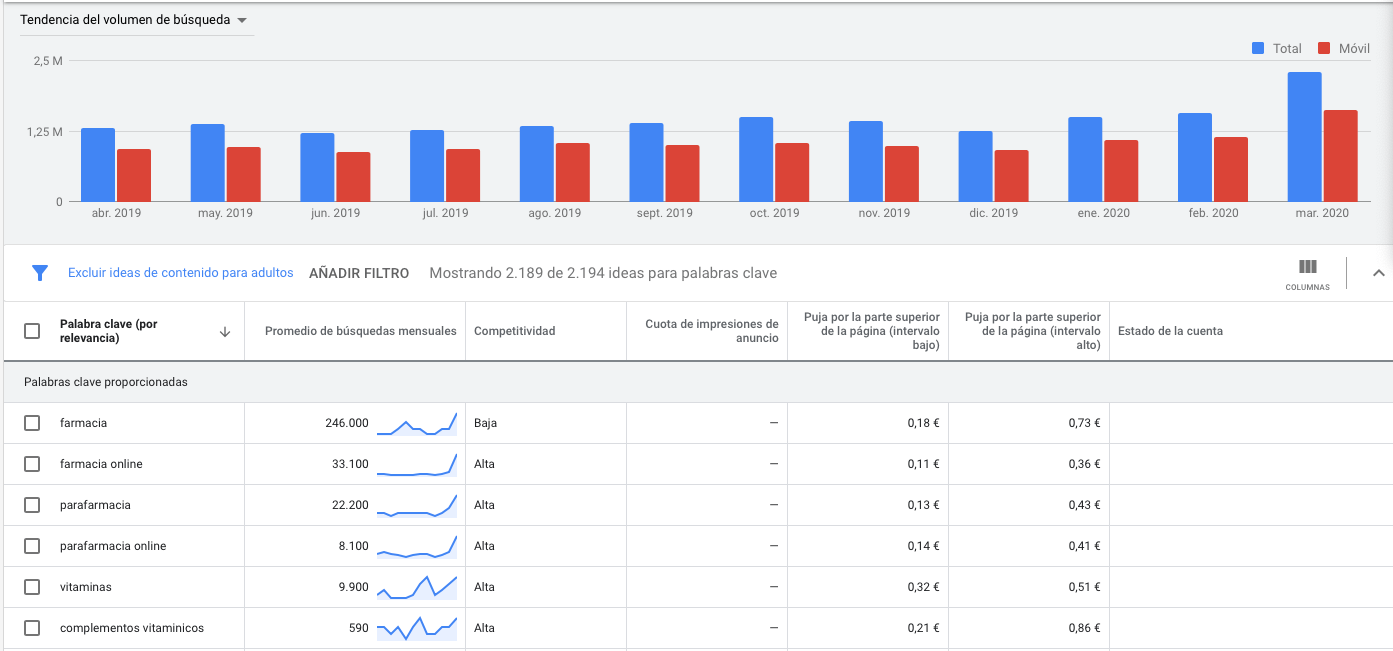

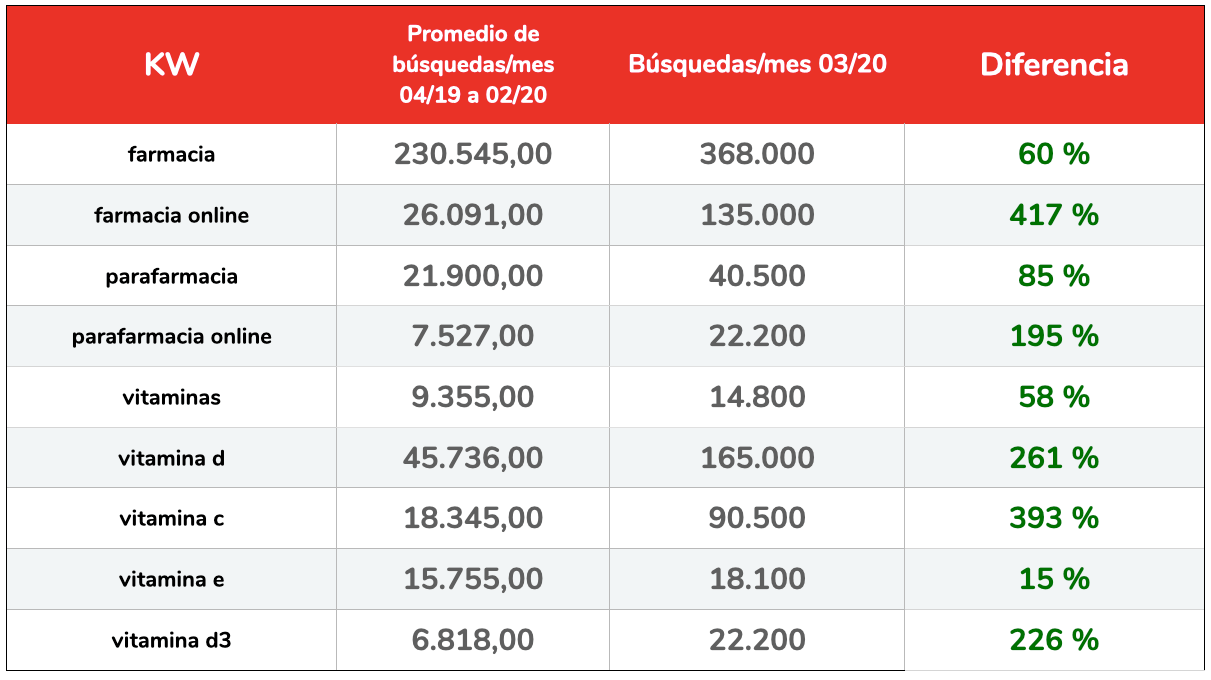

Pharmacy and parapharmacy

Once again a winning sector in this crisis. Although we have already seen before some of the searches related to hygiene and protection that have skyrocketed during the COVID-19 crisis, queries related to online pharmacies and parapharmacies or vitamin supplements that could supposedly help our defenses and immune system have also increased:

Some of the most striking increases in nutritional supplements are “vitamin c”, “vitamin d” and “vitamin d3”, probably due to news like this.

Searches for “online pharmacy” or “online parapharmacy” also grew significantly during the coronavirus crisis, from an average of 25,000 searches per month to 135,000 in the first case and tripling in the second.

To capture this demand with sustained visibility and meet EEAT/YMYL standards, boost your project with our Healthcare SEO.

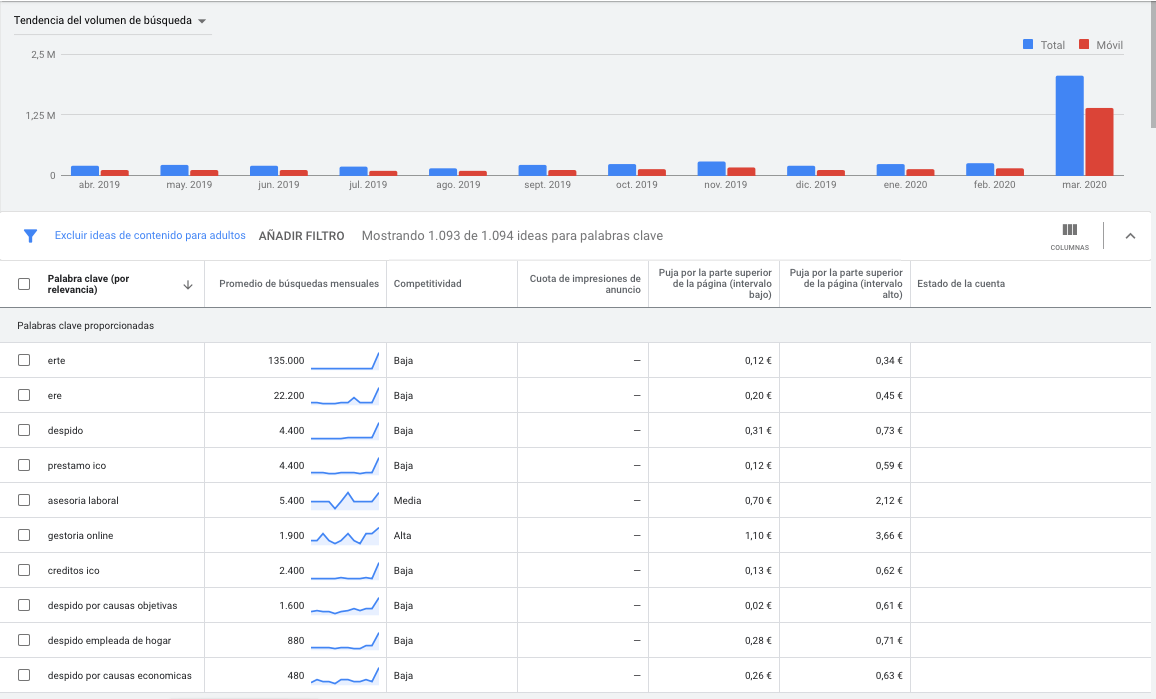

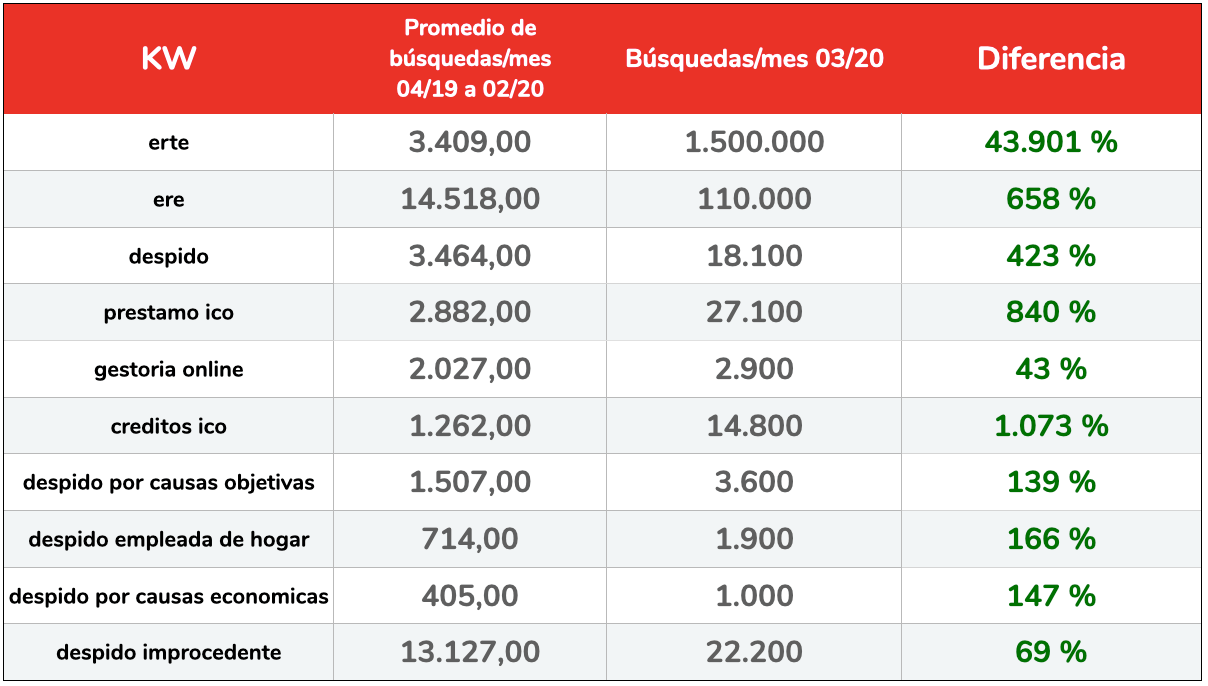

Consulting and administrative services

Another sector that has been greatly impacted by the coronavirus crisis has been the consultancies and agencies, the first reference for many self-employed and small businessmen to obtain information on government aid, processing of temporary lay-offs, dismissals, subsidies, ICO loans, etc.

The fastest growing searches include, of course, “erte,” which goes from an average of just 3,400 searches per month to no less than 1.5 million searches by March 2020. And among the rest, those that include the term “layoffs” stand out, with some particularly disheartening ones, such as “dismissal of a domestic employee”:

There was also an enormous growth in searches related to ICO loans, with a percentage increase of more than 1,000 percent. And the lack of digitalization in the consultancy sector is striking, with a very low growth of 43% in terms of searches for this service in its online modality.

Lottery and gambling

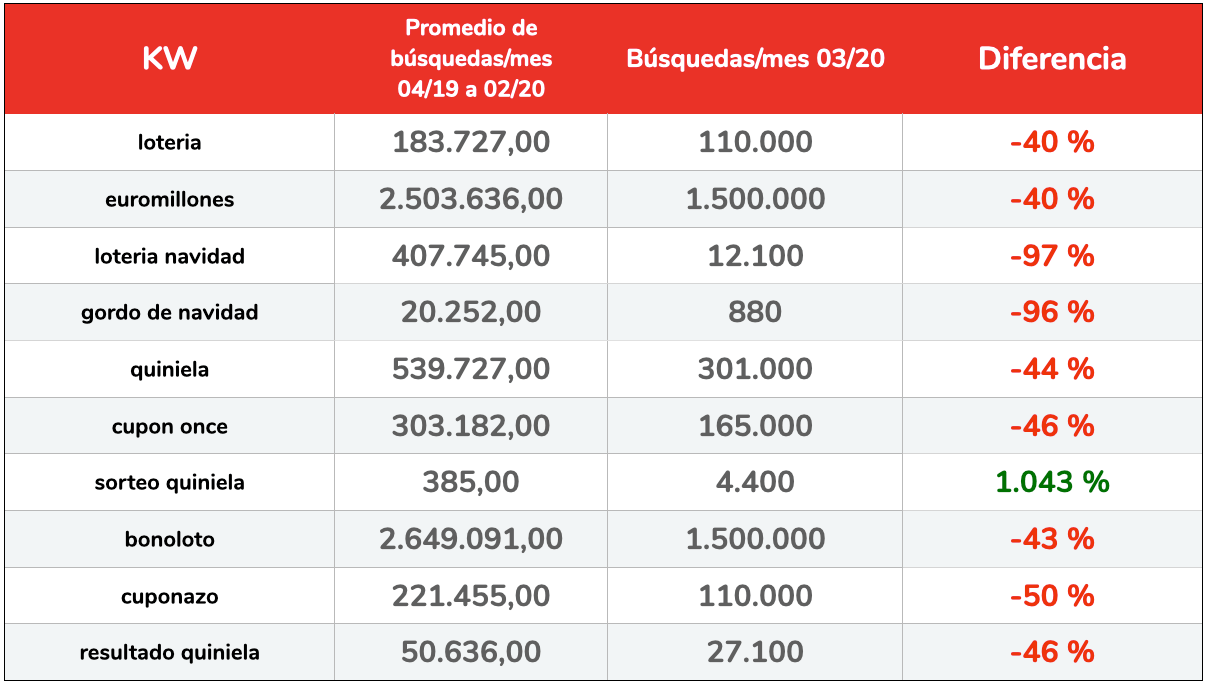

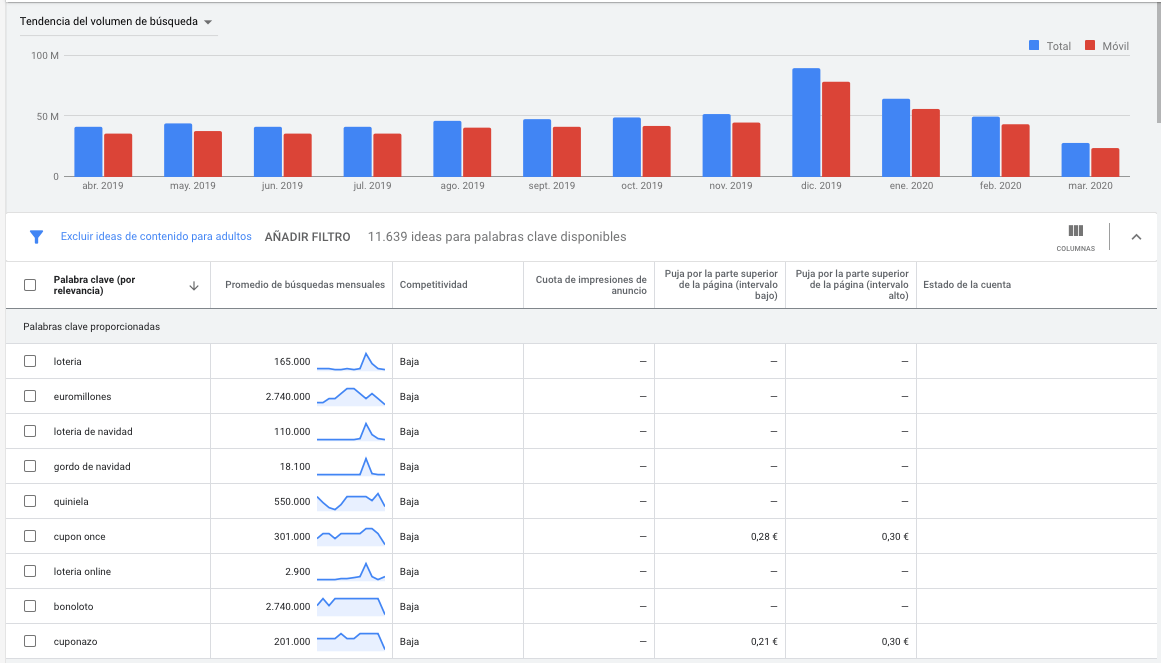

Another of the losers in the COVID-19 crisis is the lottery, pools, coupons, etc. sector, with sharp declines, especially in certain games such as Bonoloto or the ONCE coupon, probably because of how the confinement has affected the possibility of their physical acquisition:

The most popular searches suffer drops of between 40 to 100%, with the sole exception of a huge growth for the search “sorteo quiniela” of 1,043%. Indeed, with the suspension of the Football League matches, the results of the betting game have had to be settled through a draw, instead of the traditional results of the matches.

Many losers and some winners

The coronavirus crisis leaves many losers but also some winners. The confinement to which the majority of the population has been subjected has had a very negative impact on the consumption behaviors most directly related to face-to-face shopping (retail) or the consumption of services (hotels, travel, gyms, beauty, hairdressing, etc.). These would be the big losers.

But on the other hand, staying at home has forced companies that had not already done so to adopt teleworking and online meeting solutions. It has also directed leisure decisions towards the purchase of fitness products, subscribing to entertainment platforms or taking online courses.

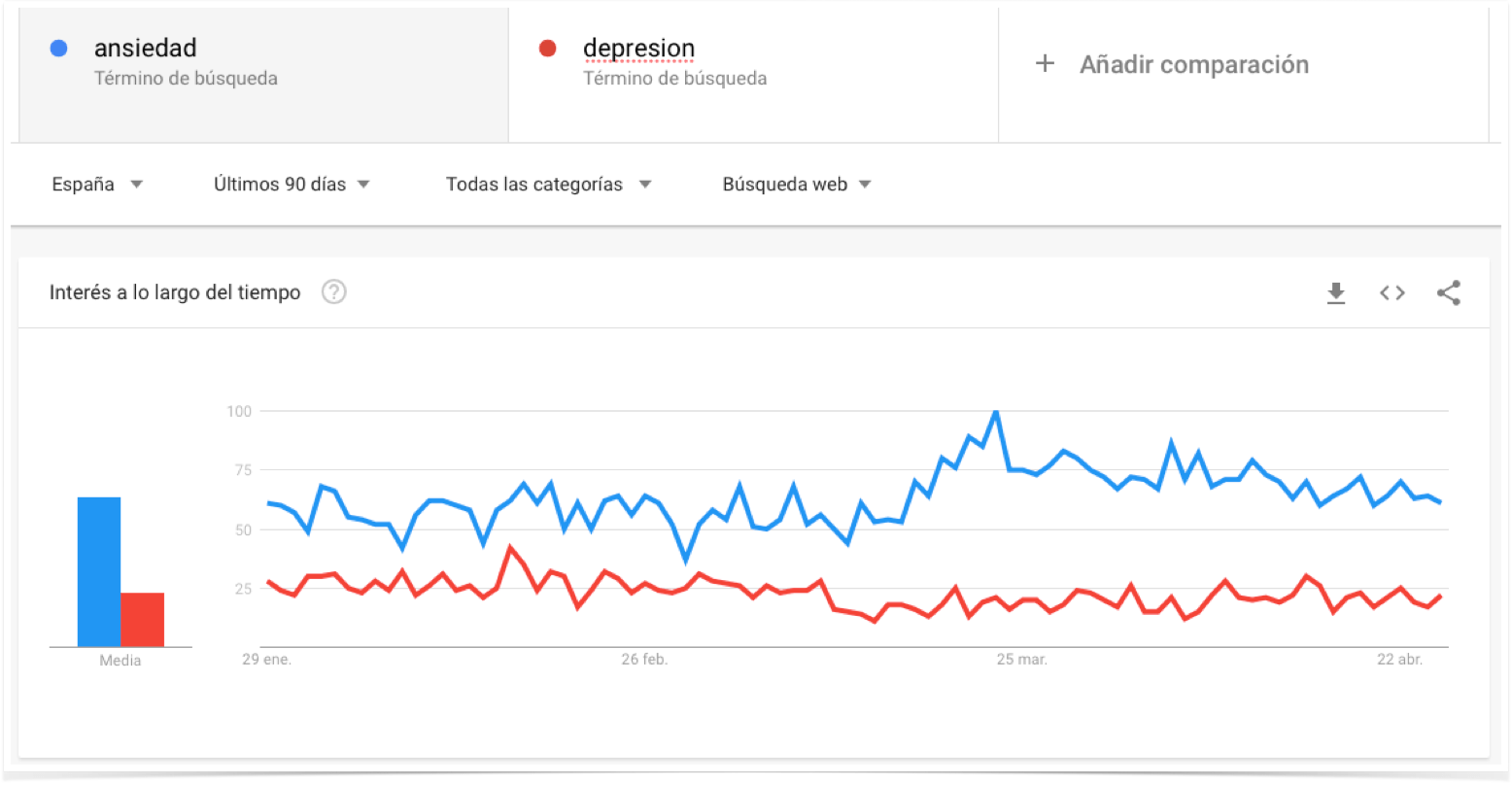

The impact of this pandemic has meant facing a totally new phenomenon for everyone and this has had obvious repercussions even on the type of disorders we may suffer from:

Following the return to that state we have begun to call the “new normal” we have no doubt that new needs and priorities will emerge that will alter, perhaps forever, the search patterns of millions of consumers. And as always in digital marketing, we must be alert to adapt to these changes and look for new visibility opportunities for our clients in response to the new needs and demands of their potential customers.

Do you miss the analysis of any sector? Would you like to share any striking findings about search behaviors that have changed in these times of the coronavirus? We look forward to hearing from you.