Written by Fernando Maciá

Index

In 2008 the SEPA (Single Euro Payments Area) began to take shape with the introduction of the euro, which led to the creation of a single economic market throughout the European Union. However, in the field of retail payments the conditions were not the most adequate and therefore it was thought that establishing a Single Euro Payments Area would be positive.

What is SEPA?

SEPA is a standard that makes it possible to make cashless payments in euros by means of a single payment model, regardless of where the bank accounts are located. This system will benefit companies as well as individuals and public institutions.

More specifically, the main purpose of SEPA is to simplify and facilitate transfers that are issued in the 28 member countries of the European Union, together with Monaco, Switzerland, Norway, Iceland and Liechtenstein. Now, international transfers within this European framework will enjoy homogeneous conditions and rules.

SEPA is intended to remove the barriers to making international payments, which in most cases involve extra costs.

This new situation is a further step towards full economic and monetary integration. SEPA will not only be beneficial for online businesses and e-commerce in general, it will also benefit public administrations in each country and end consumers. SEPA’s goal is to create a framework that enhances competition and fosters innovation.

When will SEPA be implemented?

The SEPA system is already used together with the standards that each country has, so that in the case of Spain, for example, the Customer Account Code (CCC), the system we currently use, will be changed to the IBAN or International Bank Account Number. Initially, February 1, 2014 was set as the deadline for this migration, but the European Commission has recently extended the arrival of SEPA until August 1, 2014. Until that time, payments that do not conform to the SEPA format will be accepted.

In 6 months we will be able to see how much influence it will have on e-commerce and online stores.

How will SEPA influence online stores?

Below, we outline how SEPA will affect your business depending on the payment method you use in your online store.

If your online store uses Paypal or TPV

If your online store uses Paypal or TPV it would not affect you, since the field of action of SEPA is the current accounts of the users when making or issuing a bank transfer in all the member countries of this promising and useful initiative. In other words, if your online store supports payment by bank transfer, you must take into account the IBAN (International Bank Account Number) and the BIC (Bank Identifier Code).

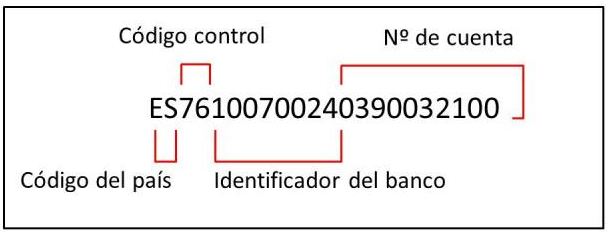

The IBAN will become the new identifier for bank accounts and will have 24 digits (current account numbers have 20). It will provide you with information about the country from which it operates, as well as the type of bank making the transaction, i.e. it will refer to the country code and include a check digit provided by your bank.

If your online store uses bank transfer

If, on the other hand, you receive or issue transfers to other European banks, you will need the BIC, which is the bank identifier for international transactions. One of the objectives of the SEPA system is that on October 31, 2016, we will stop using the BIC and will only use the IBAN for banking transactions between the different countries of the Eurozone.

It is also important to note that even if you are outside Spain, having a single account will allow you to make transfers and receive payments.

- National transfers: If you make a national transfer, from one bank to another in Spain, your bank will perform the corresponding steps to calculate the IBAN. And if not, he will show you how to obtain it so that you can include it.

- International transfers: If your transfer is international, you will need to provide them with the IBAN of your bank account and the BIC of the bank that will receive your transaction.

What benefits and advantages will SEPA bring?

Currently, it takes about three days to issue or receive a transfer, with SEPA regardless of where the bank is located, within those 33 countries, this time is reduced to a maximum of one day.

SEPA will also drastically reduce transaction and administrative costs by improving payment processes.

In conclusion, SEPA will not only favor electronic commerce in Spain, but in all the countries that adopt this system.